Joining a real estate firm in Nairobi, Kenya as an investment and property advisor was the beginning of a very interesting journey of interacting with investors and home buyers in the sector. To my surprise, in their day today transactions with their financiers and vendors in the industry, investors highly rely on advisors from either, to help them understand complex issues such as mortgages, interest rates, returns on investments, capital gains etc.

While it is the best idea for investors to engage professionals who understand such complex topics and transactions, one thing stands. Banks are there to sell mortgages while real estate vendors want to dispose their products. Therefore, whatever deal either of them gives you will always be a good deal, which might not always be the case for the investor.

With a strong financial background and experience, I found it easier to interpret these complex numbers. Projecting capital gains on property, projecting returns on investments, comparing real estate returns against offerings in other sectors, borrowing loans to acquire real estate investments etc. Working for RE firm meant the numbers should always make sense to the investor, and in favor of the firm. I.e. the numbers should convince the investor to get a real estate product from us. But one thing became complex for me, mortgages!

I never understood why investors and homeowners would have mortgage as an option. Until today, many years of working in the real estate and banking sector, I am still not convinced that investors should have mortgages as an option, to acquire real estate products in Nairobi, save for a few cases. While mortgages are a good option in some countries like the United States, at about 6% p.a, mortgages in Kenya are expensive. Some institutions offer mortgages at rates as high as 12% and others 14% per annum. These rates in the Kenyan market sounds very low when banks and real estate vendors explain them in a simplistic way, while hiding complex details. However, if an investor interpreted these numbers in a more complex way than banks do, I am convicted they wouldn’t go for a mortgage.

It’s worth noting that the mortgage market in Kenya is different depending on the mortgage issuer. However, the commercial banks and SACCOS have the biggest share of the market. For example, we have employer provided mortgages at 5% per annum and Kenya Mortgage and Refinancing Company (KMRC) which offers mortgages at 9.5% through commercial banks.

Let us look at a simplistic analysis of Maxwel, a home buyer in Nairobi intending to acquire a home worth United States Dollars 77,000 or Kenya Shillings 10,000,000 through mortgage. The conversion of this amount is based on Kenya’s current average Central Banks Rate.

For a fully financed home owner in Nairobi, Kenya, Maxwel will borrow from a commercial bank Ksh. 10,000,000 at an interest rate of 12% p.a, to be repaid in 20 years. He is a middle-income earner.

For the next 20 years, Maxwel will be repaying Kenya Shillings 110,108.61 every month as principal and interest. This simply means, Maxwel has a disposable income of shillings 110,108.61 after paying all bills and expenses per month (without rent now that they own the house).

These values are arrived at using the annuity formula:

M= P*r*(1+r) ^n

(1+r) ^n-1)

Where:

- M is the monthly payment (EMI),

- P is the loan amount (KES 10,000,000),

- r is the monthly interest rate (annual rate of 12% divided by 12),

- n is the total number of payments (loan term of 20 years multiplied by 12 months).

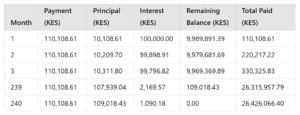

The table below shows the monthly payment schedule for the mortgage payment for the first 3 months and the last 2 months.

By the end of the 20th year, Maxwel will have a paid a total of Ksh. 26,426,066.40. This is more than 2.6 times. The interest on the mortgage is Ksh. 16,426,066.40 which is 164.26% of the principal.

Is anything that justifies such a crazy interest rate? I guess no.

What are the pros and the cons of this decision made by Maxwel?

While Maxwel enjoys being a homeowner, enjoys tax benefits and property appreciation in the long run, this also comes with a very high risk. First, default. 20 years is a long period of time and a lot would happen within this period. Incase of economic instability and he is unable to meet his financial obligations, Maxwel risks losing everything. The bank will repossess his house and sell it. Second, the interest rates paid back are high and lastly, he has limited financial power to take advantage of any other investment opportunities for the next 20 years, on assumption that he has no new incomes during the period.

Does Maxwel have an easier alternative of acquiring a home?

I am not sure whether my proposed alternative would work for Maxwel but at least I am sure that he has a disposable income of shillings 110,108 per month Kenyan money, when he is not paying rent. According to the market prices, I would assume that Maxwel acquired 2- or 3-bedroom unit somewhere in the satellites of Nairobi such as Syokimau near the Jomo Kenyatta International Airport, Kitengela, Athi River, Ruaka, etc. For a person looking for a family home, USD 77,000 will not get you a good unit in Nairobi’s Kilimani, Lavington or Westland. Most of the houses in these areas priced at that amount are not as spacious and are only perfect for investors looking to let them out.

What is the average rental payment in the areas Maxwel acquired their house? 400 United States Dollars or Kenya Shillings 50,000. That is the average rental charges.

My two cents simplistic alternative.

I would love to make my take as simplistic as possible and avoid complexities. My take will revolve around savings and investment in Money Market Funds, which is a popular investment among majority of the populace, however, I believe we have even better alternatives, depending with the risk appetites of the investors.

If without paying rent Maxwel would afford shillings 110,000 every month as disposable, he would still rent a similar house at shillings 50,000. This leaves them with shillings 60,000 disposable income.

In my analysis, with a monthly disposable income of shillings 60,000, it would take Maxwel 8 years and 7 months to accumulate shillings 12,000,000 to buy the same house if he invested his monthly disposable income to an MMF giving a 14% average interest rate per annum. We have a number of Money Market Funds Managers in the market giving even up to 16% interest per annum, compounded daily. I have however worked with 14% p.a, that being the interest I earn from my MMF. My assumption was, the house would have appreciated in value by shillings 2,000,000 which is a different topic.

How did I arrive at 8 years and 7 months?

To calculate how long it would take to reach a total of shillings 12,000,000 with shillings 60,000 per month disposable income invested in a money market fund with 14% annual interest, I used the future value of an ordinary annuity formula below.

FV=P*((1+r)^n-1)/r

- FV = Future Value ( 12,000,000)

- P = Monthly Investment ( 60,000)

- r = Monthly Interest Rate (14%÷12)

- n = Number of months (to be determined)

The table below shows the amounts invested in different months, to the last month of achieving a total amount of 12,000,000.

What are the pros and cons of this alternative?

While MMF are considered low risky and safe, an investor may experience low returns due to interest rate fluctuation, inflation and other charges by the fund manager. However, compared to a mortgage, this alternative achieves Maxwel’s objective in lesser period of time, have no risk of default and repossession, Maxwel has an open window for other short term or long-term investments as they can change their goals and objectives on the way, without any risk.

While this is a simplistic analysis, a more complex analysis taking into consideration other factors would still yield not a very different result.

One would still wonder why homeowners would still go for mortgages. Share your thoughts via our website and emails.